Union Budget 2025-26: Major Tax Reforms Introduced to Benefit Middle-Class Salaried Individuals

New Delhi:

In a significant move aimed at providing relief to the middle class, Union Finance Minister Nirmala Sitharaman presented the Union Budget 2025-26 on Saturday. This budget, the first for the third term of the Bharatiya Janata Party (BJP)-led government, introduces sweeping changes to the income tax structure, offering substantial savings for salaried individuals grappling with rising inflation and stagnant wages.

Key Highlights of the Budget:

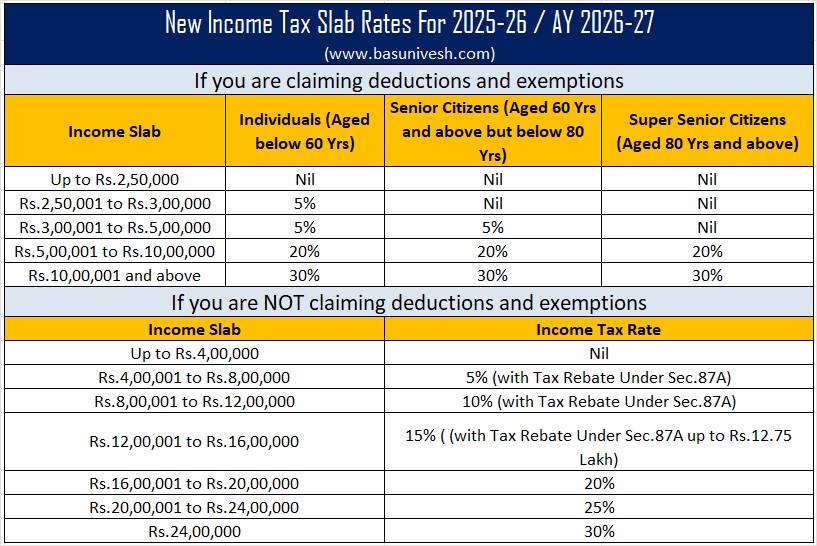

- Revised Tax Slabs for FY 2025-26:

- The new tax regime, which is now the default option, introduces a 25% tax rate for incomes between Rs 20 lakh and Rs 24 lakh.

- The 30% tax rate will now apply to incomes exceeding Rs 24 lakh, up from the previous threshold of Rs 15 lakh.

- Tax Savings for Individuals:

- Individuals earning Rs 24 lakh or more annually can save up to Rs 1.10 lakh in income tax.

- Those with an annual income of Rs 12 lakh will pay no tax, resulting in savings of up to Rs 80,000 under the new regime.

- Basic Exemption Limit:

- The new tax regime offers a basic exemption limit of Rs 3 lakh for all taxpayers, regardless of age. This means no tax is payable if the gross income does not exceed Rs 3 lakh in a financial year.

- Tax Rebate Under Section 87A:

- A tax rebate of Rs 25,000 is available under Section 87A for individuals with a net taxable income of up to Rs 7 lakh.

- Replacement of the 1961 Income Tax Act:

- The government announced plans to introduce a new Income Tax bill in Parliament next week, replacing the six-decade-old Income Tax Act of 1961.

Budget Expenditure and Economic Vision:

The Union Budget 2025-26 has allocated Rs 50.65 lakh crore in expenditure, marking a 7.4% increase over the revised estimates of Rs 47.16 lakh crore for FY 2024-25. Prime Minister Narendra Modi hailed the budget as a “people’s budget” that empowers citizens by putting more money in their hands. He emphasized that the budget lays a strong foundation for increased savings, investments, and overall economic growth.

New Tax Regime Features:

- Five Tax Slabs: The new regime offers five income tax slabs, with the highest rate of 30% applicable to incomes above Rs 24 lakh.

- Limited Deductions: Unlike the old regime, the new tax regime provides limited deductions, making it simpler and more straightforward for taxpayers.

Impact on Middle-Class Taxpayers:

The revised tax slabs and increased exemption limits are expected to provide much-needed relief to middle-class families, enabling them to save more and invest in their future. By reducing the tax burden, the government aims to boost disposable income, stimulate consumer spending, and drive economic growth.

Conclusion:

The Union Budget 2025-26 reflects the government’s commitment to fostering economic resilience and improving the financial well-being of its citizens. With its focus on tax reforms and increased expenditure, the budget is poised to create a positive impact on the lives of millions of Indians, particularly the salaried middle class.

Stay tuned for more updates on the Union Budget 2025-26 and its implications for the Indian economy.